- Fintech's Guide to Emerging Banking Trends and Opportunities

- Posts

- How would you explain today’s banking landscape to an 80-year-old?

How would you explain today’s banking landscape to an 80-year-old?

Hello and welcome to the first edition of the “Fintech's Guide to Emerging Banking Trends and Opportunities” newsletter!

The Banking, Financial Services and FinTech industries are rapidly changing with new developments, trends and technologies emerging almost every day.

Bi-weekly, I will deliver insights from leading independent analyst firms as well as my take on them to help you stay up-to-date with the industry trends.

I’ve spent the last seven years working with industry analysts – some of the most influential people in technology who have a big say when it comes to purchasing solutions.

Now, I want to help BFS and FinTech leaders understand the banks’ pain points and requirements, market trends, and emerging opportunities, from the independent perspective of industry analysts.

In this edition of the newsletter, I look at how generative AI can help banks manage risk and compliance, the top trends in payments for commercial banking, the tech trends for banking, and an interview with Meghan Anzelc – a Chief Data Officer who had built data and analytics architecture for some of the biggest insurance companies in the US.

I hope you enjoy the first edition and I would be very grateful for any feedback you share.

Best wishes,

Elena

In an era of rapid digital transformation and evolving customer expectations, staying ahead of the curve is more crucial than ever for financial institutions.

From the rise of fintech collaborations to the increasing emphasis on sustainability, these trends are reshaping how banks operate, engage with clients, and drive innovation.

The team of analysts from Datos Insights recently published its Top 10 trends for 2024.

Read the full story HERE.

In today's rapidly evolving financial landscape, banks are under constant pressure to navigate new and complex regulatory environments.

However, with the evolution of generative AI, banks can use the technology to help them overhaul their processes.

Here are five emerging applications within Risk & Compliance for banks, according to the McKinsey report “How generative AI can help banks manage risk and compliance”.

Read the full article HERE.

Chief Information Officers around the world will see their technology budgets increase, however, this increase will be only slightly above the expected inflation rates.This is one of the main trends that Gartner's 2024 CIO and Technology Executive Survey shows.The survey also outlines the ongoing need to find efficiencies within the organisations.

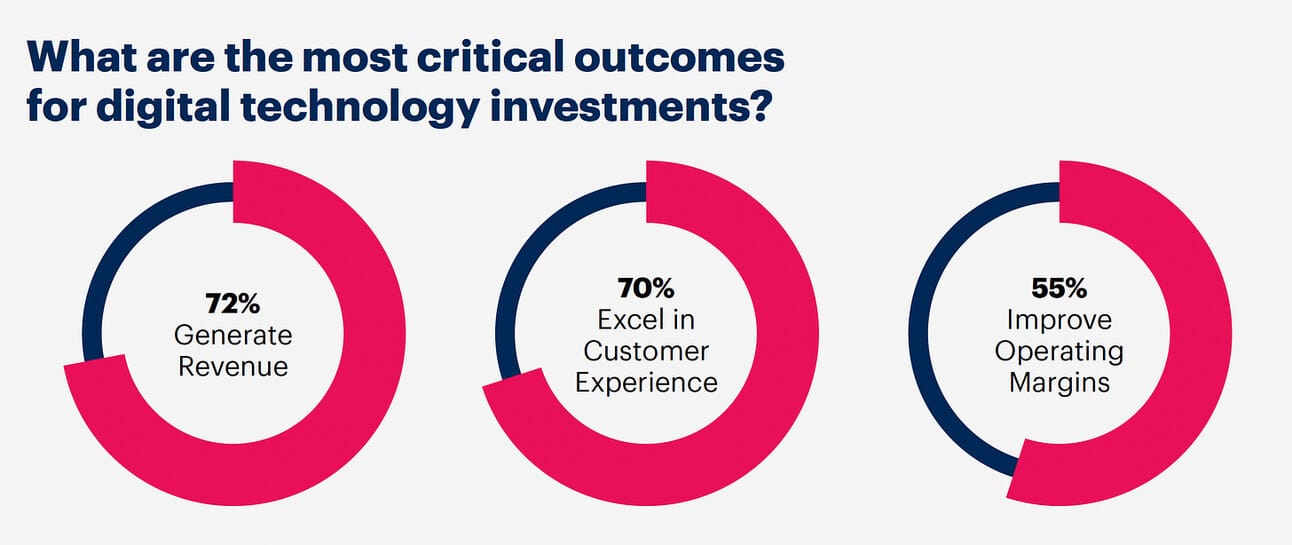

In banking and investment services, the Gartner survey shows the three most critical outcomes to be:

💰 Generate revenue🌟 Excel in customer experience📈 Improve operating margins

You can read the full article HERE.

Hello Meghan, thank you for taking the time to speak to me. Can you tell me more about yourself and how you started your career in technology? Why did you choose to go into data and analytics?

Most people pursue a PhD in physics because they want to be a professor. I pursued a PhD with the intent of doing research full time after getting a PhD. While I was in grad school, I realised there are almost no pure research jobs anymore - almost everything is a combination of teaching and research. Additionally, most of the US Department of Energy labs had been under a hiring freeze for a few years and there were very few openings. Careers are different up close compared to what I thought they would be when I was an undergraduate. Not better or worse, just different. I realised there were only a couple hundred people in the world who cared about my dissertation research, and any broader benefit of my work beyond basic science research wouldn't appear for decades, if ever. I wanted to do something more applied and where I could see the impact.

Read the full story HERE.

Recently, I have been attending a lot of webinars and reading many posts about change, new technologies, and company strategies aiming to revolutionise the banking and financial services industries.

This made me think about how the time when I opened my first “grown-up” bank account back in the year 2000.

At that time Bulgaria was modernising its processes and the old communist way of getting your salary cash-in-hand was no longer used so everyone needed to have a bank account. There were the fancy new banks like Raiffeisen or United Bulgarian Bank which, if memory serves me correctly, at the time was owned by a Greek banking group.

You can read the full article HERE.